- 接合関連

生体認証機能付ICクレジットカードのメリット——多様化する決済手段

目次

多様化する電子決済の方法

皆さんは普段、お買い物をするときに、現金でお支払いでしょうか?それともクレジットカードを使うことが多いでしょうか? 近年は、交通系のICカード決済や、スマートフォンによるQRコード決済が広く使われるようになりました。また、スマートフォンやウェアラブルデバイスそのものに決済機能が搭載され、店頭の端末にかざすことで支払いすることもできるようになっています。

数ある決済方法の中でも、安全性と確実な決済のために、世界的に「クレジットカード決済における生体認証機能」が広がっていくことが期待されるとともに、今後の急速な普及が予想されています。本稿では各種決済手段の現状と今後の展望について解説いたします。

伸び続けるクレジットカード市場と多機能化

クレジットカードのトータル市場が伸び続ける中、現在、かざすだけで通信による決済が行われる「非接触ICカード」の利用も世界中で増えています。

現在、主流になりつつある非接触ICカードが登場する前は、ICチップを搭載し暗証番号(PINコード)を入力することによって決済を行う「接触型ICカード」が広く普及していました。その接触型ICカードの市場の成熟には、約18年を要したと言われています。それに対して非接触ICカードは、たった8年という短いスパンで市場が広く拡大しました。

カードの高機能化が進むにつれて、市場への浸透・普及のスピードが高まっているのはなぜでしょうか。その大きな理由は、生体認証カードを含む高機能ICクレジットカードの製造方法やプロセス、材料で革新が起きていることにあります。詳しくは後述しますが、実はデクセリアルズの異方性導電膜(ACF)が、その技術革新に大きく貢献しています。

増大した非接触ICカードの利用額

いま世界中で普及が進んでいる非接触ICカードは、決済時にカードを端末にタッチするだけで支払いが完了し、接触型カードのように暗証番号(PINコード)の入力を求められません。ユーザーにとっては、決済がスピーディに済むという大きな利点があります。しかしPINを求められないということは、他人のカードでも決済できてしまうという、防犯上の危険があります。

そのため非接触型ICカードは、セキュリティ上の理由からタッチのみで支払いができる金額に、国ごとに上限が定められています。例えば、2022年9月現在、日本では1万円の決済まではタッチ動作だけで支払いが完了できますが、この上限を超えると取り扱いを拒否されるか、またはPINコードの入力やサインを求められます。

モバイル決済の方式とメリット・デメリット

また近年、クレジットカードに代わる決済手段として普及が進んでいるのが、「モバイル決済」と呼ばれる、スマートフォンでの非接触決済です。スマートフォンでの非接触決済には大きく2種類、画面に表示したQRコード*やバーコードをお店に読み取ってもらう/店側のQRコードやバーコードを読み取る方式と、デバイスに搭載されたICが店舗の端末と通信して決済を行う、Felicaに代表される「非接触IC方式」があります。

モバイル決済の方法

| QRコード/バーコード方式 | 非接触IC方式 |

|---|---|

以下の2通りの決済方法が可能

|

|

*QRコードは㈱デンソーウェーブの登録商標です。

QRコード(バーコード含む)決済は、この数年間に人口の多い中国で急速に普及したことで注目を集めましたが、技術的には1990年代から存在していました。おサイフケータイやカード型電子マネーに利用されるNFC(Felica)よりもシンプルで、店舗側で専用端末などを用意する必要がなく、「導入の初期コストが低い」「小規模店舗で利用しやすい」というメリットがあります。

モバイル決済は利便性が高いため、日本を含め世界中で広がっていますが、一方でデメリットもあります。その一つがセキュリティの問題です。スマートフォンによるQRコード・バーコード決済は近年、不正利用や個人情報の漏洩などの課題が指摘されています。セキュリティを向上するために、2段階認証による本人確認の強化が進んでいますが、その結果として、簡便性の低下やユーザーのスマートフォン決済に対する不安の拡大が懸念されています。

モバイル決済のメリット/デメリット

| メリット | デメリット |

|---|---|

|

|

「確実な決済」を可能にする生体認証カード

上記のように、スマートフォンによる決済は便利ですが、いつでも確実な決済が行えるとは限らないという大きな問題があります。そのため、世界中にクレジットカードを発行している大手クレジットカード会社は、ユーザーのメリットの観点から、「全ての決済が、いつでも自社のカードで可能である」ことを強く望んでいます。生体認証カードがこれから急速に普及することが確実視されているのは、このためです。

スマートフォンによるモバイル決済ができない環境でも、生体認証カードを持っていれば、強固なセキュリティを確保しながらクレジットカードを利用することができます。クレジットカードの生体認証は、「指紋認証センサー」の機能を持つICチップによって行われます。

ユーザーはカードを使用する際に、カード表面に露出している指紋認証エリアに指紋をあてることで、認証を行います。世界で一人だけの自身の指紋が認証された場合のみ、そのカードは決済が可能になりますので、 高度なセキュリティが実現できます。

指紋認証センサーを搭載するメリット

指紋認証センサーをクレジットカードに搭載するメリットには、以下が挙げられます。

- 決済時に暗証番号(PINコード)の入力が不要となり、決済処理自体の時間も短縮可能

- 暗証番号(PINコード)の管理が不要なため、パスワード忘れのリスクを低減でき、セキュリティ性の高い安全な決済環境を実現可能

- 指紋情報はカード内だけで保管され、都度、指紋と照合する。そのためサーバーでの指紋情報の保持が必要なく、指紋情報自体の漏洩を防ぐことが可能

- 店舗側は、新しい決済端末の導入が不要なケースもある

こうした指紋認証カードは決済用のクレジットカードだけでなく、社員証などの個人認証にも使えるほか、オフィスや工場の入退室管理や、マンションなどの住居の鍵にも応用が可能です。また指紋認証のセキュリティは高度なことから、高額なサービスの提供も考えられます。

生体認証カードに使われる指紋認証センサーは、静電容量方式を採用しています。センサー部分に触れた指紋の凹凸に対して電極が反応して、電荷の移動を測定することで、サンプルとなる登録した指紋情報との一致を確認します。使用電力量がとても少なく、静電気で駆動するため、電池が要らないことが大きなメリットです。静電容量方式による生体認証は現在、世の中に流通している多くのスマートフォンでも採用されています。

経済産業省も2025年までに生体認証を義務付け

2020年10月、日本国内での生体認証カードの普及を後押しする大きなニュースが報道されました。経済産業省が「通販サイトの運営者や出店者を対象に、クレジットカードでの決済時に生体認証などによる本人確認を2025年4月までに義務付ける方針」を示したのです。本人確認方法としては、現状、スマートフォン上での指紋による生体認証などが想定されています。義務化に踏み切った背景には、インターネット通販において、カードの不正利用による詐欺被害の件数が増加していることがあります。日本クレジット協会の調べでは、2021年のカードを悪用した被害額は330億円にものぼり、EC取引のさらなる増加にともなって、被害の拡大が懸念されています。

クレジットカードの不正利用では、近年、AIを用いてカード番号を推測したり、個人宛のメッセージから企業の偽サイトに誘導して個人情報を盗み出したりするなど、手段が巧妙化していることが経済産業省の調査でも判明しています。生体認証カードが普及することで、そうしたカードを利用した被害を未然に防ぐことが期待されます。

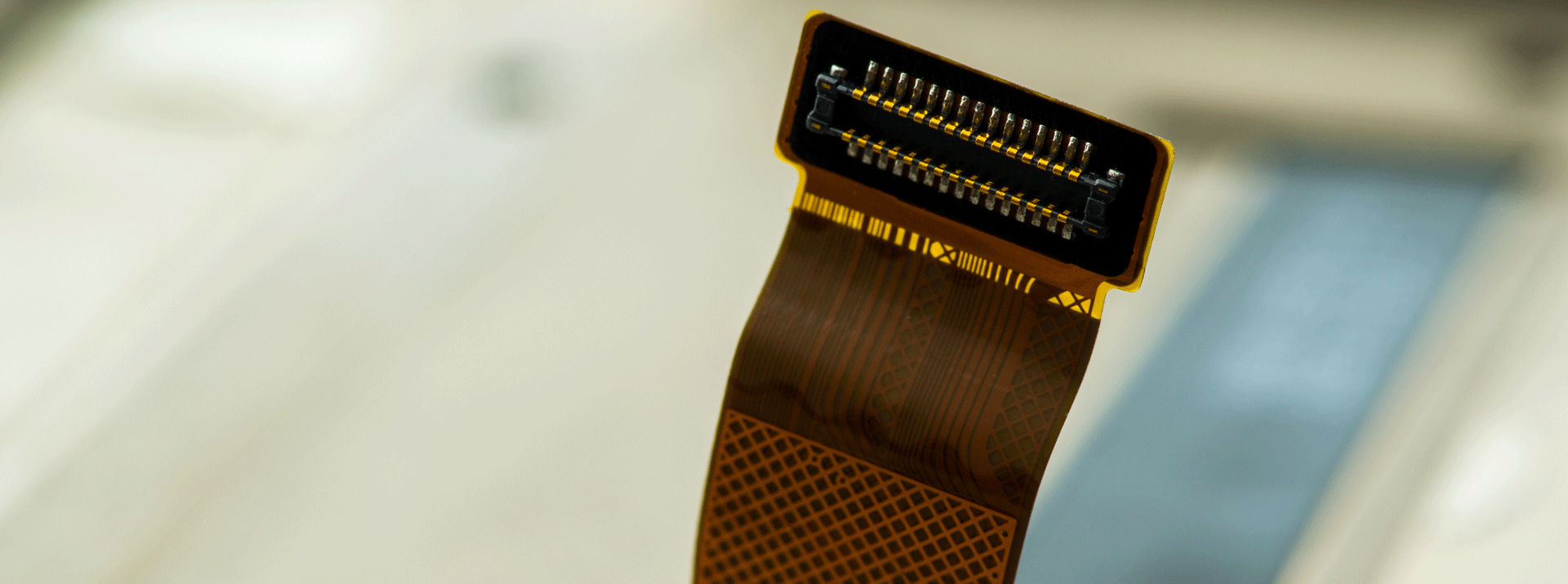

生体認証カードの実装に採用が進むACF

その生体認証カードに指紋認証センサーを実装する材料として、近年多くのクレジットカードメーカーで採用が進んでいるのが、私たちデクセリアルズのICカード向け異方性導電膜(ACF)です。非接触ICカードの実装にはこれまで、はんだ付けやはんだペーストが用いられるケースが多く見られました。

しかし、生体認証カードは従来の非接触ICカードに比べて接続する端子の数が増えるため、はんだ付けやはんだペーストでは実装の難易度が高まり、時間・作業コストが増加することが問題となっています。デクセリアルズのICカード向けACFは、それ一つで「接着」と「導電」の機能を果たす材料であることから、生体認証カードの生産の工数が低減できるほか、既存の設備をそのまま流用できることから採用が広がっています。近年のクレジットカードの多機能化の進歩と、それに搭載されている当社のICカード向けACFについては、過去のTECH TIMESでも取り上げましたので、こちらの記事もぜひご参考ください。近い将来、決済の主流となることが予想される生体認証カードの普及に、私たちは製品を通じて貢献することを目指します。

関連記事

私たちデクセリアルズはデバイスの進化に欠かせない材料や次世代のソリューションを生み出す、マテリアルメーカーです。

電子部品、接合材料、光学材料をはじめと世界中のパートナーと新しい価値を生み出していきます。

- SHARE

当社の製品や製造技術に関する資料をご用意しています。

無料でお気軽にダウンロードいただけます。

お役立ち資料のダウンロードはこちら

当社の製品や製造技術に関する資料をご用意しています。

無料でお気軽にダウンロードいただけます。

お役立ち資料のダウンロードはこちら