- Optical Products

China's Fast-Evolving Automotive Market: Electrification and Autonomous Driving Reshaping Mobility

Series: "Future Vehicles"——Evolving automotive technologies around the world

This series presents automotive technology trends in four global markets through interviews with representatives from Dexerials' subsidiaries.

Japan | U.S. | Europe | ▶China

目次

- 1Challenges in China's automotive market amid the evolution of EVs and autonomous driving

- 2Government-led electric vehicle (EV) adoption and electrification in the Chinese market

- 3Intensifying competition and the emergence of EV manufacturers in China's automotive market

- 4Chinese manufacturers' strategy to expand global market share through EV exports

- 5Solving the "roof problem" unique to Chinese vehicles through autonomous driving and optical technologies

- 6Dexerials (Shanghai) Corporation: key roles and comprehensive technical support from the design stage

- 7Optical materials and anti-fogging technologies supporting the future of China's automotive market

Challenges in China's automotive market amid the evolution of EVs and autonomous driving

In 2012, Dexerials officially established a permanent base in Shanghai (Dexerials (Shanghai) Corporation). We spoke with Patrick Sun, Assistant Department Manager for Sales, who has led Dexerials’ automotive business in the Chinese market for over a decade, about the characteristics of the Chinese market and the corporation's strategy.

Government-led electric vehicle (EV) adoption and electrification in the Chinese market

Driven by strong government policies supporting electrification and autonomous driving, China’s automotive industry is undergoing rapid transformation.

——Why is China shifting to EVs so rapidly? What role do government policies play?

In recent years, EV adoption in China has accelerated significantly. One of the primary drivers of this trend is government support. For conventional gasoline-powered vehicles, consumers are required to obtain a license plate through a bidding process. In some cities, the cost of a license plate can reach approximately 100,000 yuan (about USD 14,000), and unsuccessful bidders are unable to register a vehicle.

By contrast, EV buyers are exempt from license plate bidding fees, making EV ownership significantly more affordable than ownership of gasoline-powered vehicles. In addition, tax incentives further encourage consumers to choose EVs. Large cities such as Shanghai and Beijing have also implemented vehicle ownership restrictions that do not apply to EVs. These policies are providing a strong impetus for the adoption of electric vehicles.

——What changes are occurring in China's EV market as competition intensifies?

As competition intensifies, more attention is being paid to software rather than hardware, particularly to autonomous driving technology. Chinese information and communications technology (ICT) companies, including smartphone manufacturers with strong global market presence, are increasingly collaborating with major Chinese automobile manufacturers (OEMs) to develop vehicles equipped with state-of-the-art features.

Notably, some Chinese OEMs have publicly stated their willingness to assume limited responsibility for certain autonomous driving functions. Although this compensation is limited to a fraction of all autonomous driving such as parking or garage-related accidents, the manufacturers' willingness to accept responsibility is accelerating EV adoption.

In Shanghai, autonomous taxi services are operating in designated areas. Currently, safety personnel remain seated in the passenger seat; however, as AI continues to collect data, the accuracy of autonomous driving is expected to improve further.

Intensifying competition and the emergence of EV manufacturers in China's automotive market

In China, the number of EV manufacturers has increased rapidly, and competition has intensified year by year. As the industry evolves from hardware-centric development to software-driven vehicle manufacturing, what are the characteristics of Chinese OEMs' speed and development capabilities?

——What is the competitive environment of China's automotive market like?

China’s automotive market is characterized by intense price competition. For example, a model from one of the country’s largest OEMs was priced at 150,000–160,000 yuan (approximately USD 20,000–22,000) three years ago, whereas a newer model is now sold for less than USD 14,000. When government subsidies are taken into account, discounts of 30–40% have become common.

Vehicle prices have continued to decline year after year, and an increasing number of manufacturers are no longer able to sustain their operations. The number of automakers, which once reached around 100, has now fallen to approximately 40. Looking ahead, this figure is expected to decline further to around 20 through industry consolidation.

——Why are Chinese OEMs able to develop products much faster than their counterparts in other countries?

We have been partnering with major Chinese OEMs since around 2016. In discussions with senior executives at these companies, we asked about their top development priorities, and the answer was "speed."

Whereas many Western OEMs typically require around five years to develop a single model, some Chinese OEMs are able to complete a new model in 9 months to 1 year. During the time it takes a Western OEM to develop one model, a Chinese OEM may release two to three new vehicles. This speed is a key source of the competitiveness of Chinese-manufactured automobiles.

——What is the difference in market share between PHEVs and EVs in China?

Based on actual sales figures of OEMs that sell both vehicle types, plug-in hybrid electric vehicles (PHEVs) currently outsell EVs by an overwhelming margin. Because China's geography is vast and includes many cold regions, users tend to choose PHEVs, which can operate on both electricity and gasoline, reducing concerns about driving range and charging availability. Although the driving range of EVs continues to improve, battery performance can deteriorate, especially during the cold winter months. As a result, real-world driving range is often shorter than the figures published by manufacturers (WLTC or CLTC values).

Chinese manufacturers' strategy to expand global market share through EV exports

As growth in domestic demand begins to plateau, OEMs are shifting their focus toward expanding exports to overseas markets. What strategies are Chinese manufacturers pursuing to drive global expansion?

——How do you expect the global share of Chinese-manufactured EVs to change in the coming years?

Following the change in administration in the United States this year, many countries have introduced restrictions on imports of Chinese electric vehicles to protect their domestic industries, creating uncertainty about the near-term outlook. Nevertheless, in the long term, Chinese EV manufacturers are expected to continue expanding their presence in global markets by leveraging their price competitiveness.

Given declining prices and slowing growth in domestic demand, Chinese OEMs can no longer rely solely on competition within the domestic market and must increasingly focus on export expansion. In fact, many major OEMs are experiencing stagnation in domestic sales growth, and are seeking to sustain overall sales by strengthening exports. *1

At the same time, overseas sales are steadily increasing, with major OEMs maintaining a monthly export volume in the tens of thousands of vehicles. Total automobile exports from China reached a record high of approximately 5.2 million units in 2024, acting as a growth driver that offsets the slowdown in domestic demand. Exports to Southeast Asia and the Middle East are increasing especially quickly, with several Chinese manufacturers placing emphasis on markets in the Middle East and Russia. In addition, rising export volumes have led to increased orders for the construction of car-carrying vessels, with some Chinese manufacturers reportedly investing in their own dedicated shipping fleets. *2

(Sources: *1Chinese automakers’ foreign investment tops domestic spending for first time, data shows | Reuters,*2Which EV manufacturers performed the best in 2024 so far?, TRENDS Research & Advisory – China’s EV Industry is Conquering New Territories, *2China's BYD begins operating its own car-carrying ships through leasing and ownership in response to surging EV exports | Comprehensive analysis of China's EV hegemony | Toyo Keizai Online)

Solving the "roof problem" unique to Chinese vehicles through autonomous driving and optical technologies

——What types of technical inquiries and challenges do you receive from Chinese automotive-related companies?

Recently, we have received a growing number of inquiries related to glass roof technologies. While glass roofs are less common in vehicles in other countries, they are widely adopted in China. One advantage of glass roofs is that they create a strong sense of openness, similar to that of a convertible. However, glass roofs can reflect mobile phone screens, particularly when devices are used in the front passenger seat, making displayed content visible to rear-seat occupants. We have been asked whether our anti-reflection film (ARF) technology can be used to suppress reflections of mobile phone screens on glass roofs.

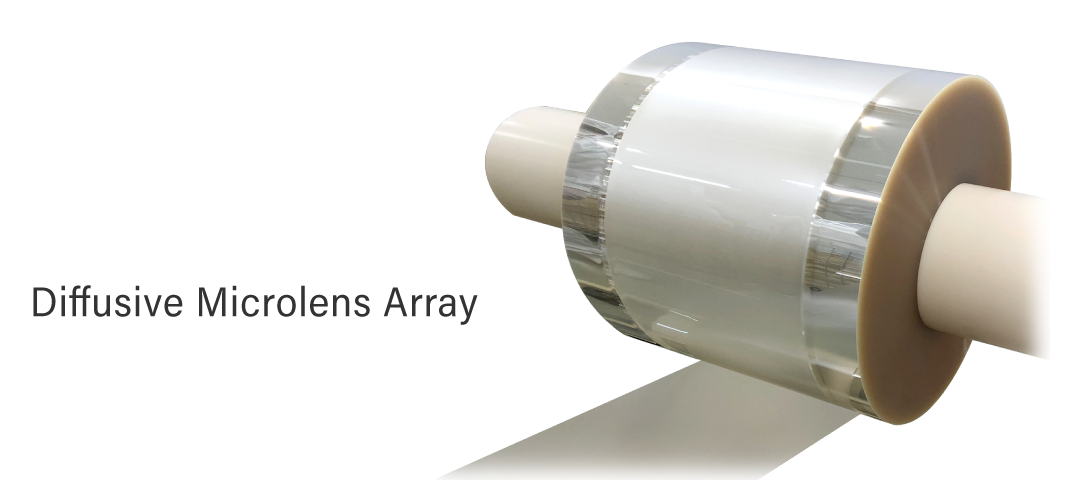

In the areas of autonomous driving, we also receive many inquiries related to technologies that prevent cameras and sensors from fogging in order to improve safety. Leveraging our accumulated expertise in anti-fogging technologies, we are working with OEMs to develop solutions. As Chinese OEMs aim to rapidly put autonomous driving technologies into practical application, they are paying close attention to technologies that enhance sensing accuracy, such as our anti-fogging and moth-eye technologies.

——Besides autonomous driving, what other in-vehicle technologies are Chinese OEMs focusing on developing?

In fields particularly related to our company's business, the focus is on increasing display sizes. Five years ago, 8-inch and 9-inch displays were the industry standard; today, many vehicles are equipped with 15.6-inch displays, comparable in size to large laptop screens, and some models feature displays measuring 20 inches or more. An increasing number of vehicles now incorporate panoramic displays spanning the entire dashboard in front of both the driver and front passenger seats.

The growing adoption of larger and multiple displays is directly creating new sales opportunities for our products, such as anti-reflection film (ARF). Leveraging our many years of experience in optical materials, Dexerials aim to contribute to the development of new technologies for automotive roofs and window glass.

Dexerials (Shanghai) Corporation: key roles and comprehensive technical support from the design stage

Dexerials (Shanghai) Corporation provides technical proposals and development support from the design stage onward through the establishment of relationships with local customers.

——What roles does Dexerials (Shanghai) Corporation play in the Chinese market?

Dexerials (Shanghai) Corporation was originally established under our predecessor, Sony Chemicals, and was officially reorganized into its current form in 2012. We began working with automakers on a full-scale basis after 2016.

The automotive supply chain is highly complex. Before a single project can be completed, close collaboration is required with multiple parties, including OEMs, design companies, assembly companies, display manufacturers, and cover glass manufacturers. Dexerials (Shanghai) Corporation has a comprehensive understanding of this process and provides technical proposals to ensure that our products are selected for each project.

——In your opinion, what are the strengths of Dexerials' products that are so highly regarded in the Chinese market?

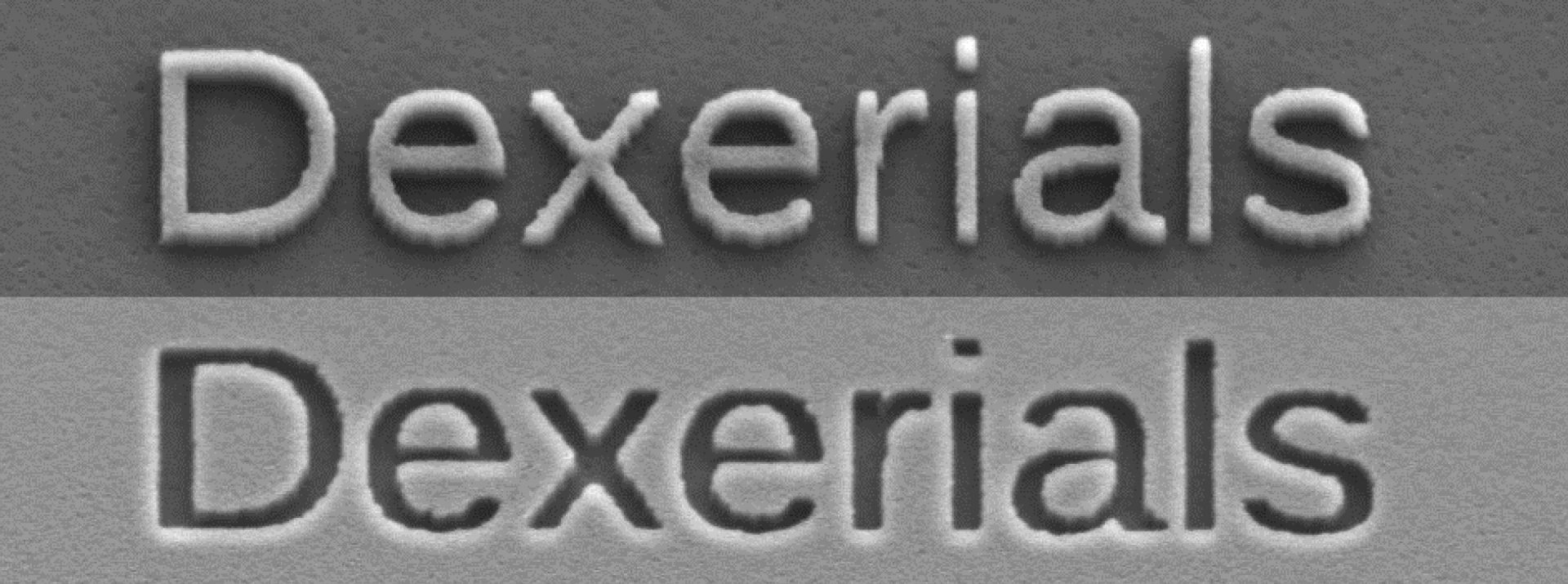

Our anti-reflection film (ARF) is widely used in vehicles manufactured by major EV automakers in the Chinese market. It has earned high praise from customers for its reliability, low reflectance, and consistent quality. Because automobiles can directly affect human lives by virtue of their characteristics, high levels of reliability are required for all parts and materials. While local suppliers are becoming progressively competitive, many customers ultimately choose our products due to their reliability.

Optical materials and anti-fogging technologies supporting the future of China's automotive market

China aims to become the world's first country to realize an autonomous driving society. We asked about Dexerials' contributions to this goal and its outlook for the future.

——Looking ahead, in what direction will China's automotive industry head?

We expect autonomous driving to spread across the country in 2 to 3 years. Currently, driverless buses and autonomous taxis are operating primarily in industrial areas, and a large number of autonomous taxis are deployed in model cities such as Wuhan. While these vehicles still face safety challenges, autonomous driving is expected to be adopted in China earlier than in other regions, driven by strong government backing.

As autonomous driving and electrification continue to advance rapidly in China, demand for in-vehicle displays and optical components is becoming increasingly diverse. Looking ahead, Dexerials will continue to contribute to the new form of mobility envisioned by Chinese manufacturers through its optical, adhesive, and sealing material technologies.

Related articles

- SHARE

We provide materials on our products and manufacturing technologies.

Feel free to download it for free.

Download Materials

We provide materials on our products and manufacturing technologies.

Feel free to download it for free.

Download Materials