- Bonding Products

Advantages of Credit Cards with Biometric Authentication

Contents

- 1 Diversified electronic payment methods

- 2 Growth of different credit card types

- 3 Increased usages of contactless smart cards

- 4 Mobile payment methods and its pros and cons

- 5 Biometric cards for reliable payments

- 6 Advantages of fingerprint sensors

- 7 METI mandates biometrics identification by 2025

- 8 Dexerials’ ACFs are being increasingly adopted in biometric cards

Diversified electronic payment methods

In recent years, instead of cash payments, card and QR code payments have become more popular. In addition, smartphones and wearable devices are equipped with payment functions to make payments by hovering over a terminal. With the many options for in-store payments these days, it is not uncommon to question which payment method to choose. Furthermore, since the outbreak of COVID in 2020, there has been a sudden focus on contactless payments to prevent the spread of infection.

Among the many payment methods, usage of credit cards with biometric authentication is expected to expand worldwide for reliable and secure payments. This article describes the current status of the various payment methods and their future prospects.

Growth of different credit card types

As the credit card market continues to grow, the use of contactless smart cards, is also increasing around the world. Chip-and-PIN cards, cards equipped with an integrated circuit (IC) chip that require a PIN code to make a payment, were widely used before the advent of contactless smart cards. It is said to have taken about 18 years for the chip-and-PIN card market to mature. In contrast, the market for contactless smart card has expanded widely in a short span of only eight years.

Biometric cards with fingerprint authentication are expected to become the next credit card trend. Currently, the number of issued biometric cards is about several million per year, but the market is expected to expand at a much faster rate than the chip-and-PIN and contactless smart cards mentioned above.

Innovative manufacturing methods, processes, and materials contribute to the increasing market penetration rate as cards become more advanced. As will be discussed in detail later, Dexerials’ Anisotropic Conductive Films (ACFs) have contributed significantly to the technological advancements of smart cards, including biometric cards.

Increased usages of contactless smart cards

Contactless smart cards allow payments to be completed simply by tapping a card on a terminal. For the user, the biggest advantage is the quick payments. However, not inputting a PIN poses a security risk, as payments can easily be made with someone else’s card. For this reason, each country sets a limit on the amount that can be paid using a contactless smart card. For example, as of September 2022 in Japan, payments of up to 10,000 yen can be completed with a tap. But if this limit is exceeded, the transaction will be declined, or the user will be asked to enter a PIN code or provide a signature.

After COVID, there was a movement to raise this limit in many countries, prioritizing the reduction of human contact. In fact, in countries where the payment limit was increased, the amount of money spent using contactless smart cards increased significantly.

Mobile payment methods and its pros and cons

Recently, contactless payments via smartphones, ‘mobile payments’, have become popular as an alternative to credit card payments. There are two main types of mobile payments: (1) QR codes*/barcodes method and (2) Contactless method, both described in the table below.

Mobile Payment Methods

| QR Code/Barcode method | Contactless method |

|---|---|

Includes the following two payment methods:

|

|

*QR Code is a registered trademark of DENSO WAVE INCORPORATED.

Although QR code (including barcode) payments have existed since the 1990s, they have attracted attention because of their rapid adoption in China over the past few years. It does not require dedicated terminals at stores, and thus, allows for lower initial costs and is easier for small businesses to use.

Mobile payment is spreading all over the world because of its convenience. However, a major disadvantage is the security risk. In recent years, problems such as unauthorized use and personal information leaks have been pointed out for QR code/barcode payments. To improve security, two-step verification systems are implemented, which is less convenient as it will take more time to make payments. Furthermore, payments cannot be made when the smartphone runs out of battery or in places where there is no signal. It also takes time and effort to install apps and register the card information.

Pros/cons of mobile payments

| Pros | Cons |

|---|---|

|

|

Biometric cards for reliable payments

As mentioned above, smartphone payments are convenient. But the major problem is that they are not reliable at all times. Therefore, major credit card companies are aiming to create a way that allows users to make reliable and secure payments with their cards at any time. This is why usage of biometric cards is expected to expand rapidly.

For biometric cards, users authenticate the payment by placing their fingerprint on the fingerprint authentication area on the card. Only when that person’s unique fingerprint is verified can the card be used for payment, providing a high level of security.

Advantages of fingerprint sensors

Advantages of having credit cards with fingerprint sensors include the following:

- Does not require a PIN code entry and shortens payment processing time

- No need to manage PINs, reducing the risk of forgetting passwords.

- Fingerprint information is stored only on the card, eliminating the need to maintain fingerprint information on servers and prevents the fingerprint from being leaked online.

- In some cases, stores do not need to install new payment terminals.

Such fingerprint authentication cards can be used not only for credit cards, but also for personal identification such as employee ID cards. They can also be used to control access to offices, factories, apartments and other residences.

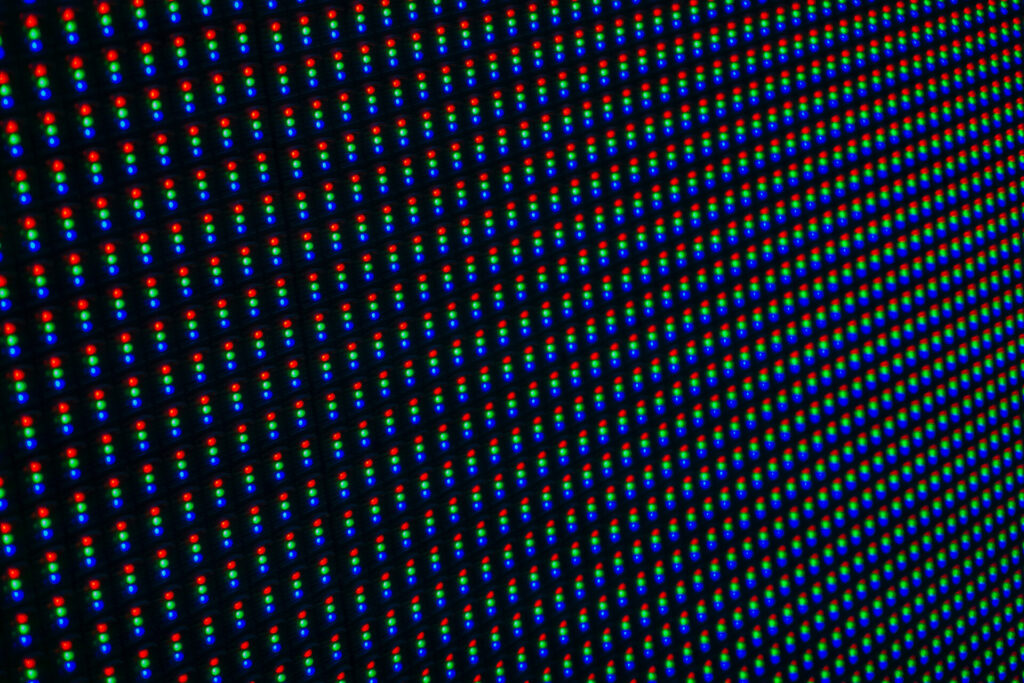

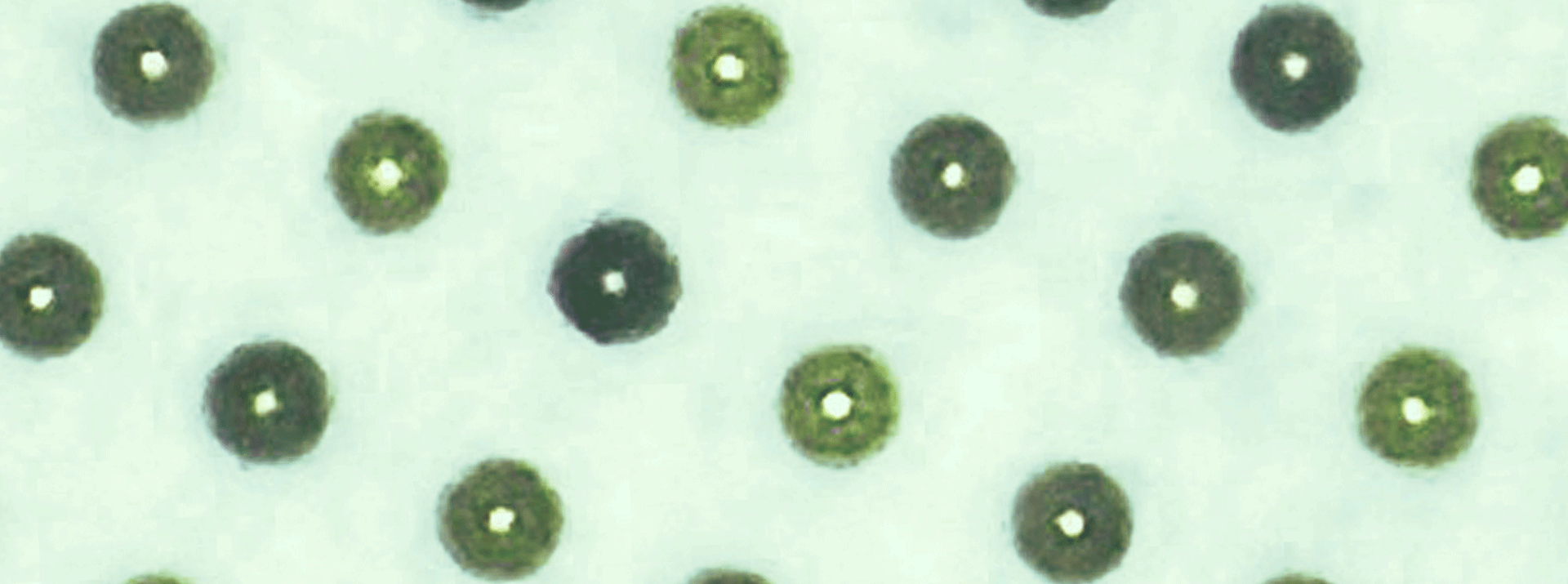

Fingerprint sensors used in biometric cards utilize the capacitive method. An electrode reacts to the bumps of the fingerprint that touches the sensor and measures the transfer of electric charge to confirm a match with the registered fingerprint information. The main advantage is that it uses very little energy and is powered by static electricity, so it does not require batteries. Capacitive biometric authentication is also used in many smartphones.

METI mandates biometrics identification by 2025

In October 2020, Japan’s Ministry of Economy, Trade, and Industry (METI) announced that it plans to mandate biometric identification for credit card payments made on e-commerce and vendor sites by April 2025. Smartphone biometric authentication using fingerprints is expected to be the future method of identification. The decision to make it mandatory was prompted by the increasing amount of fraudulent credit card usage online. According to a survey by the Japan Credit Card Association, the amount of damage caused by the unauthorized use of cards in 2021 amounted to 33 billion yen, and there are concerns that the damage will increase with the further growth of e-commerce transactions.

METI found that credit card frauds have become increasingly sophisticated in recent years, using AI to guess credit card numbers, and directing users to fake corporate websites to steal personal information from messages sent to individuals. The widespread use of biometric cards is expected to prevent damages caused by such frauds.

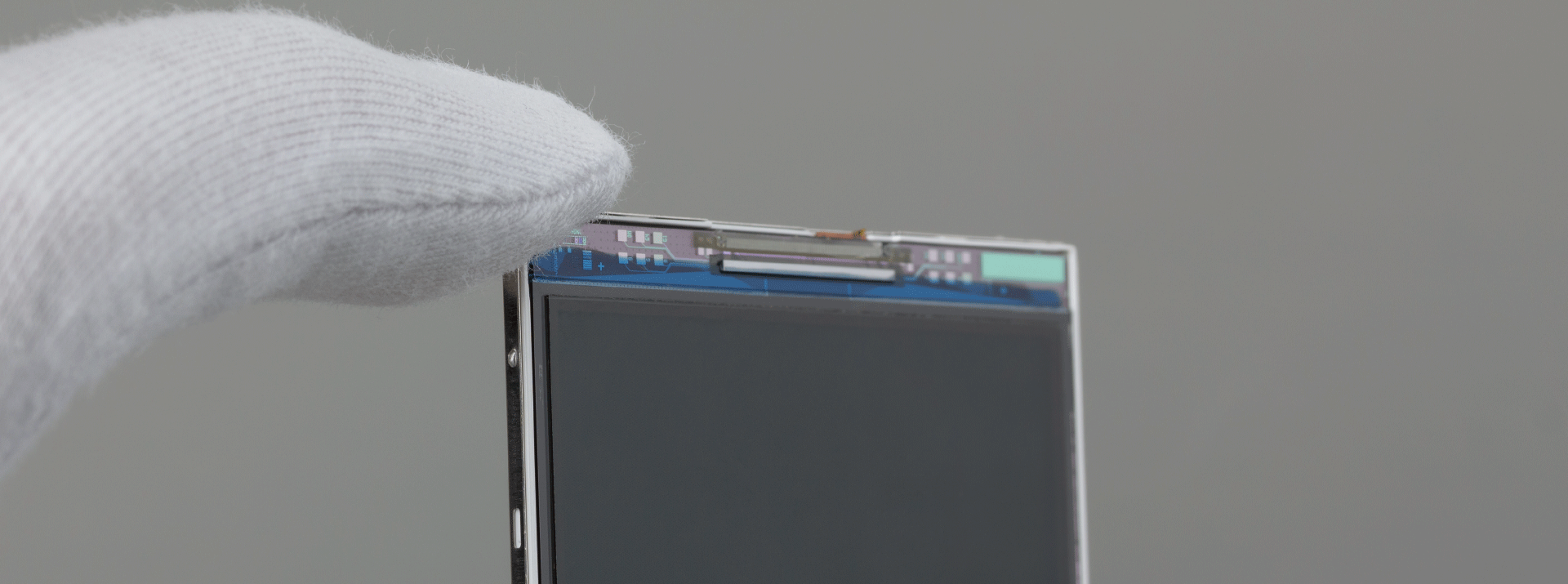

Dexerials’ ACFs are being increasingly adopted in biometric cards

Many credit card manufacturers have adopted Dexerials’ Anisotropic Conductive Film (ACF) to mount fingerprint authentication sensors on biometric cards. Until now, soldering and solder paste had been used for bonding contactless smart cards.

However, biometric cards have more pads to connect than conventional contactless smart cards. As Dexerials’ ACFs can adhere and conduct, they replace soldering and solder paste. Utilizing ACFs can reduce the man-hours required for biometric card production. Please refer to this article for more information on recent technological advancements in the multifunctionality of credit cards and Dexerials’ ACFs used in smart cards. Dexerials aims to contribute to increase of biometric cards usage, which are likely to become the mainstream payment method in the near future.

- SHARE

Back to top

Back to top  Contact us

Contact us